Executive Summary

The convergence of financial services and digital commerce is entering a transformative phase, moving beyond simple partnerships to a fundamental rewiring of how and where financial products are consumed. This shift is defined by Embedded Finance, the seamless integration of financial tools into non-financial platforms, ecosystems, and customer journeys. For C-suite leaders across all sectors, understanding this $63 billion market is no longer a strategic option; it is a critical defensive and offensive imperative for future revenue growth and customer relevance. This briefing provides a global analysis of the embedded finance ecosystem, its driving forces, and a strategic framework for capitalizing on what constitutes the most significant redistribution of financial value since the advent of digital banking.

The Embedded Finance Revolution: Redefining the Point of Sale

Embedded finance dismantles the traditional paradigm where financial services are a destination, a separate app or a physical branch. Instead, it makes financial products a native feature of a user’s natural digital habitat. Consider the following, which are no longer novel but expected:

-

-

- Buy Now, Pay Later (BNPL) at checkout for an e-commerce purchase.

- Embedded insurance offered when booking a ride or buying electronics.

- One-click business lending within an accounting software dashboard.

- Branded payment processing and wallets within retail apps.

-

The value proposition is clear: by meeting customers at their moment of need with a frictionless, contextualized offering, platforms dramatically increase conversion rates, unlock new revenue streams, and significantly deepen customer loyalty.

The market scale validates its significance. The global embedded finance market is projected to accelerate at a staggering CAGR of over 25%, reaching an estimated USD 1 trillion within next decade. This growth is not confined to one region; it is a global phenomenon, with North America and Asia-Pacific leading in adoption and innovation.

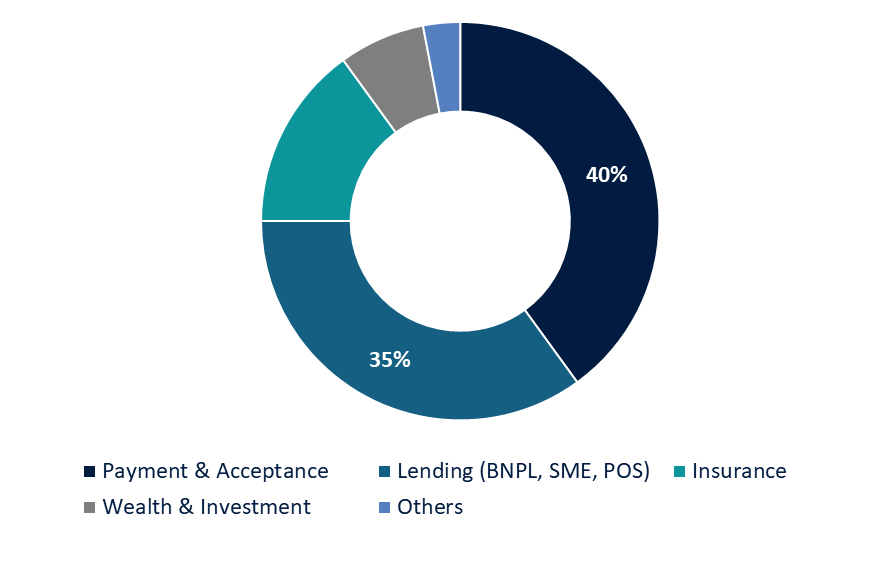

Embedded Finance Revenue Pools by Product Line (Indicative Share)

Core Drivers of Disruption: Why Now?

The rapid ascent of embedded finance is fueled by a powerful convergence of technological, economic, and consumer behavioral trends:

-

-

- API-driven Infrastructure: The maturation of Banking-as-a-Service (BaaS) providers has democratized access to regulated financial capabilities. These providers offer the licensed, compliant, and technological “plumbing” that allows any company to embed financial products via APIs, negating the need to build costly, regulated infrastructures from scratch.

- Evolving Consumer Expectations: Modern consumers, accustomed to the seamless experiences of Uber and Amazon, demand instant, contextual, and personalized services. They no longer tolerate friction-filled processes; they expect financial tools to be integrated into their daily digital routines.

- The Platform Economy’s Quest for Growth: For non-financial companies, embedded finance represents the pinnacle of customer monetization. It transforms a previously cost-centric function (e.g., checkout) into a profit center through revenue sharing, while creating a powerful data flywheel that offers deeper insights into customer behavior.

-

Deconstructing the Ecosystem: Key Segments and Revenue Pools

Embedded finance is not a monolith. Its value is distributed across several high-impact segments, each with distinct dynamics and leaders.

Key Embedded Finance Segments, Key Players, and Value Proposition

|

Segment |

Description | Key Players | Value to Platform |

|

Embedded Payments |

Integrating payment processing directly into a platform’s checkout. | Stripe, Adyen, Square |

Increased conversion rates, revenue share on processing fees, valuable transaction data. |

| Embedded Lending | Offering credit, loans, or BNPL at the point of sale or within workflow. | Affirm, Klarna, OakNorth |

Higher average order values, new commission-based revenue, increased customer stickiness. |

|

Embedded Insurance |

Contextual offering of relevant insurance products (e.g., travel, gadget, warranty). | Shift Technology, CoverGenius | New high-margin revenue stream, enhanced customer value proposition and trust. |

| Embedded Wealth | Access to investment, brokerage, or savings products within non-finance apps. | Plaid, Paxos |

Engagement monetization, data insights, serving the entire customer financial lifecycle. |

Embedded payments currently dominate the revenue share, but embedded lending is the fastest-growing segment, driven by the global BNPL boom. The strategic value of each segment varies by industry; for example, embedded insurance is a game-changer for travel and electronic marketplaces, while embedded lending is transformative for B2B software and e-commerce.

Strategic Implications: A Call to Action for Leadership

The rise of embedded finance presents a fundamental strategic choice for every company that has a customer relationship.

For Non-Financial Enterprises (Incumbents & Digital Natives):

This is a historic opportunity to unlock new, high-margin revenue streams and build a more defensible competitive moat. The strategic question shifts from “How do we sell our product?” to “How do we solve our customer’s broader needs?” The first step is a ruthless audit of your customer journey to identify moments of financial friction that can be transformed into moments of value.

For Traditional Financial Institutions:

The threat of disintermediation is real. If every brand becomes a fintech, where does that leave the traditional bank? The winning response is not to resist but to become the enabling engine. Banks must decide to compete (by building their own embedded offerings for their clients) or to provide the infrastructure (by becoming a BaaS provider for the ecosystem). Passive observation is not a viable strategy.

Navigating Implementation: Critical Considerations

Success in embedded finance requires more than technical integration. Leadership must navigate:

-

-

- Regulatory Compliance: Partnering with fully licensed BaaS providers is crucial to navigate the complex web of global financial regulations.

- Customer Experience: The financial offering must feel like a native, seamless part of the user journey, not a bolted-on third-party product.

- Technology Partnership: Selecting the right BaaS partner is a strategic decision, impacting speed-to-market, scalability, and future product flexibility.

- Data Security & Privacy: Handling financial data brings heightened responsibility for cybersecurity and transparent data usage policies.

-

Conclusion: The Inevitable Fusion of Commerce and Finance

Embedded finance is not a passing trend; it is the logical endpoint of digitalization – the complete integration of commerce and finance. Within a decade, the term itself may become redundant, as the expectation will be for all financial services to be contextual, embedded, and instant.

The window for establishing a leadership position is closing rapidly. The time for strategic deliberation is over. The mandate for leadership is clear: Audit your customer journeys, identify the embedded opportunities, and choose your role in this new value chain or risk being chosen for you.

Discover how to leverage embedded finance for your business, schedule your strategic consultation today.