The Strategic Lens: Why This Market Demands Executive Attention

The construction and mining machinery sector is not merely growing – it is fundamentally reinventing itself. For C-suite leaders, this represents both a $200 billion opportunity and an existential challenge. The traditional levers of competitive advantage – scale, distribution, and cost efficiency – are no longer sufficient.

Our analysis, informed by engagements with Fortune 500 heavy equipment manufacturers and mining conglomerates, identifies three non-negotiable strategic imperatives:

-

-

- The Automation Mandate: Autonomous haulage systems are no longer pilots – they are profit drivers. Rio Tinto’s autonomous fleet in Australia delivers 30% lower operating costs and 15% higher utilization. Competitors without a clear autonomy roadmap will face irrelevance by 2030.

- The Energy Transition Paradox: While electric excavators dominate headlines, their total cost of ownership remains prohibitive without government subsidies. Winning players are hedging bets – Caterpillar’s dual-fuel (diesel/hydrogen) engines exemplify this pragmatism.

- Emerging Markets’ Infrastructure Asymmetry: India’s $1.4 trillion infrastructure pipeline isn’t just about demand – it’s about redefining price-performance thresholds. Chinese OEMs like SANY and Liugong are gaining share with over 50% cost-advantaged machinery, forcing Western players to rethink localization strategies.

-

The Boardroom Agenda: Critical Questions for Leadership Teams

1. Where Are You on the Autonomy Curve?

-

-

- Laggards: Still relying on operator-dependent fleets

- Followers: Piloting telematics and assisted operations

- Leaders: Deploying fully autonomous mines (e.g., BHP’s AI-powered drills reducing blast-hole drilling costs significantly)

-

Action Item: Conduct a capability gap assessment against Komatsu’s FrontRunner autonomy platform.

2. Is Your Electrification Strategy More Than Virtue Signaling?

The EU’s Stage V emissions regulations and California’s 2024 off-road equipment mandates create compliance urgency – but winning requires:

-

-

- Battery-as-a-service models (Volvo CE’s partnership with Goldcorp)

- Circular economy integration

-

Action Item: Pressure-test your R&D portfolio – are you investing in disruptive technologies (e.g., sodium-ion batteries) or just incremental improvements?

3. How Are You Mitigating the China Risk?

China controls 45% of global construction equipment production and is weaponizing export controls on critical components like hydraulic systems. Contingency options:

-

-

- Dual-sourcing strategies (Liebherr’s shift from ZPMC to Korean suppliers)

- Nearshoring in Mexico/Eastern Europe

-

The New Battlegrounds: Where Competition Will Be Won or Lost

1. Aftermarket Services: The Hidden $90 Billion Profit Engine

Most OEMs still treat aftermarket services as a reactive cost center rather than a strategic growth lever. Yet, our analysis reveals that 40% of potential aftermarket revenue – worth $90 billion globally – remains uncaptured, lost to independent workshops and counterfeit parts. The winners are those transforming this space through predictive monetization models:

-

-

- Caterpillar’s Condition Monitoring now drives major parts revenue by using AI to preempt failures before they occur, locking customers into high-margin service contracts.

- A major OEM’s telematics converts machine data into $1,200/unit/year in incremental service revenue – proving that the real money isn’t in selling iron, but in selling uptime.

-

The playbook is clear: Shift from break-fix to predictive-as-a-service models, or risk surrendering 50%+ of lifetime equipment profits to third parties.

2. Rental & Pay-Per-Use: The $58 Billion Disruption Accelerating Asset-Light Strategies

The rise of non-ownership models is fundamentally altering competitive dynamics. United Rentals’ $5.8 billion revenue (2023) proves contractors increasingly prefer flexible access over capex burdens – a trend growing at 9% CAGR versus 3% for traditional sales. Leaders are responding with radical shifts:

-

-

- Volvo CE’s “Pay-per-Hour” model in Europe ties leasing payments to actual usage metrics (fuel consumption, idle time), improving customer ROI while securing major market share of the region’s equipment deliveries.

- Sunbelt Rentals’ AI-powered dynamic pricing adjusts rates in real-time based on equipment utilization data, squeezing 20% higher margins from rental fleets.

-

For incumbents, the choice is stark: Embed telematics into your financial offerings to compete with rental giants or become a low-margin manufacturer for their fleets.

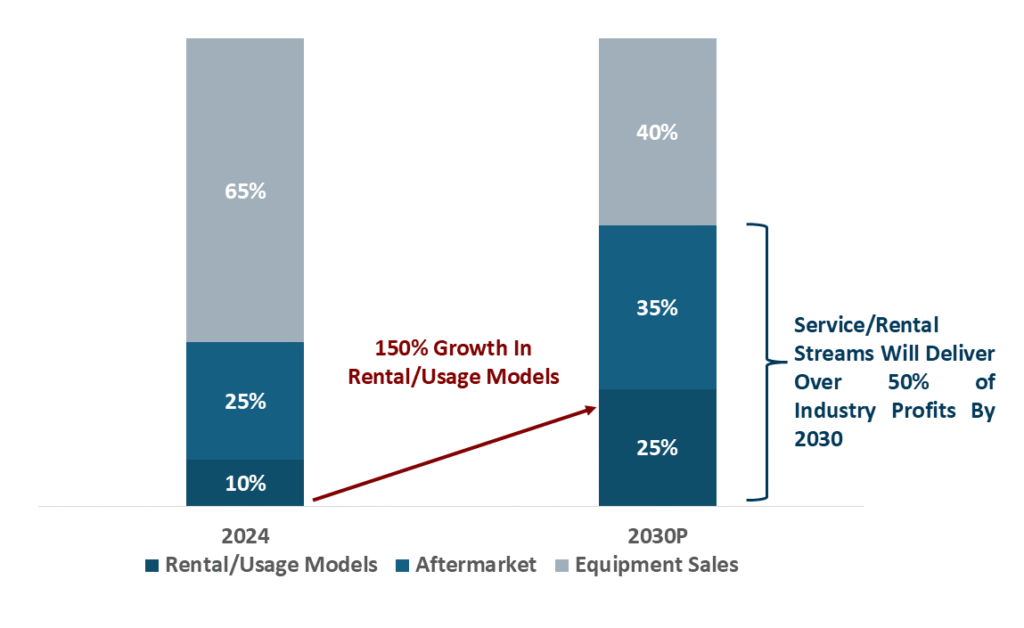

Profit Pool Shift in Construction & Mining Machinery (2023 vs. 2030 Projection)

Key Takeaway: The next wave of value creation won’t come from hardware, but from data-driven service layers and usage-based revenue models. Players who delay this pivot will face commoditization – or worse, disintermediation by fintech-enabled rental platforms.

The Path Forward: A 24-Month Execution Roadmap

|

Quarter |

Strategic Priority | Key Milestone |

| Q1-Q2 2025 | Autonomy Readiness |

Complete Level 2 automation retrofits for 30% of fleet |

|

Q3-Q4 2025 |

Electrification Beta | Pilot two electric loaders with mining majors under TCO contracts |

| 2026 | China+1 Supply Chain |

Secure alternative hydraulic component suppliers with 12-month inventory buffer |

Phase 1 (0-6 Months): Rapid Capability Build

-

-

- Deploy Level 2 automation retrofits across 30% of high-utilization fleets to capture immediate productivity gains

- Launch two electric equipment pilots with binding TCO commitments from anchor customers – critical for validating real-world economics beyond ESG optics

-

Phase 2 (6-18 Months): Scalable Monetization

-

-

- Transition 20% of aftermarket revenue to predictive service contracts using embedded telematics

- Establish alternative component supply chains with 12-month inventory buffers, prioritizing hydraulic systems and EV drivetrain components

-

Phase 3 (18-24 Months): Model Reinvention

-

-

- Achieve 15% of revenue from usage-based models (equipment-as-a-service, pay-per-ton) to offset cyclical sales volatility

- Institutionalize AI-driven dynamic pricing across rental fleets to maximize asset yield

-

Critical Watchpoint: The window for first-mover advantage is closing fast. Deere’s $300M investment in autonomous orchards and Komatsu’s lithium-ion battery joint ventures prove that 2024-25 is the inflection point for capital allocation decisions. Organizations still “evaluating options” by 2026-27 will face prohibitive catch-up costs – if they survive at all.

Conclusion: The Decisive Decade Ahead

The global construction and mining machinery sector stands at an inflection point where strategic boldness will separate future market leaders from obsolete incumbents. Our analysis reveals that traditional competitive advantages – manufacturing scale, dealer networks, and even brand legacy – are being rapidly eroded by three tectonic shifts:

-

-

- The Autonomy Imperative: Companies without Level 4 autonomous capabilities by 2026 will face 30% cost disadvantages in mining and large-scale construction

- The Service Revolution: Aftermarket and rental revenues will account for 60% of industry profits by 2027 – but only for players who successfully transition from equipment sellers to uptime guarantors

- The China Factor: Geopolitical realignments require dual supply chains, with near-term pain (15-20% cost increases) for long-term resilience

-

The 2024-2025 window demands uncompromising action:

-

-

- Rebalance R&D portfolios immediately: Shift 40% of development budgets from incremental hardware improvements to autonomous systems and predictive service platforms

- Accelerate ecosystem partnerships: Form JVs with tech providers (NVIDIA for AI, Proterra for electrification) rather than building capabilities in-house

- Radicalize your business model: Test equipment-as-a-service pilots with risk-sharing contracts – the United Rentals of tomorrow will be tech platforms, not equipment owners

-

This is not about weathering another cyclical downturn – it’s about redefining the rules of competition. The machinery companies that will dominate 2030 are those making uncomfortable decisions today: cannibalizing traditional sales channels, accepting lower margins during the transition, and betting big on autonomous/electric architectures. The data shows these moves payoff: early movers in autonomy are already seeing 2-3x valuation premiums versus peers.

Schedule your strategy stress test now – before disruption leaves you with obsolete assets and evaporating margins.