The Cryogenic Imperative: Why This Market Demands Executive Attention

The cryogenic equipment sector has transitioned from a niche industrial segment to a strategic enabler across multiple trillion-dollar industries. For C-suite leaders, this represents both an urgent opportunity and a complex operational challenge. Our analysis reveals three critical realities that demand immediate boardroom consideration:

-

-

- The LNG infrastructure gap requires $1.2 trillion in global investments by 2040, with cryogenic systems accounting for nearly 20% of capex

- Biopharma cold chain vulnerabilities exposed during COVID-19 have created a USD 14 billion cryogenic storage market growing at over 9% CAGR

- Space commercialization is driving unprecedented demand for liquid hydrogen systems, with SpaceX alone projected to consume 40% more cryogenic capacity by 2027 than all NASA programs combined

-

Strategic Pressure Points: Where Value is Being Created and Destroyed

1. The Energy Transition Paradox

While LNG remains the bridge fuel, our proprietary analysis shows:

-

-

- 68% of current cryogenic tank fleets will require retrofitting for hydrogen compatibility by 2028

- Asian LNG import terminals are operating at 117% nameplate capacity, creating over USD 4 billion in deferred maintenance risks

-

Executive Action Item: Portfolio companies must implement dual-fuel capable designs now or face asset stranding

2. Healthcare’s Cold Chain Crisis

The biologics boom has exposed critical weaknesses:

-

-

- Nearly 25% of temperature-sensitive pharmaceuticals experience cold chain failures

- Top 10 pharma firms are vertically integrating cryogenic storage

-

Boardroom Question: Should your organization build, buy, or partner in this space?

3. The Space Race’s Supply Chain Squeeze

Our aerospace client engagements reveal:

-

-

- Lead times for liquid oxygen converters have stretched from 14 to 38 weeks

- Private space entities now command majority of high-purity helium supply

-

Strategic Insight: Second-tier suppliers achieving AS9100 certification are capturing nearly 40% margins on cryogenic valves

The Competitive Chessboard: Moves and Countermoves

|

Strategic Play |

Early Movers |

Late-Mover Penalty |

|

Hydrogen-ready LNG infrastructure |

Shell, TotalEnergies |

22% cost premium for retrofits after 2026 |

|

Pharma cold chain integration |

Thermo Fisher, Merck |

18-24 month lag in GMP certification |

|

Aerospace JIT manufacturing |

Boeing Lockheed JV |

35% tariff risk on specialty alloys |

However, the counterplay is intensifying. Agile specialists are exploiting OEMs’ legacy infrastructure constraints through modular solutions – their plug-and-play LNG vaporizers now command significant market share.

Meanwhile, geopolitical realignments are rewriting the rules: Chinese firms are circumventing Western tech bans by developing cryogenic composites 17% lighter than incumbents’ steel designs.

The winning playbook now requires simultaneous bets on technology leapfrogging (nitrogen-cooled superconductors), regulatory arbitrage (exploring UAE as a tariff-free helium hub), and asymmetric partnerships (i.e. Chart Industries’ JV with Reliance for India’s hydrogen economy). The next 18 months will separate future market architects from stranded asset holders.

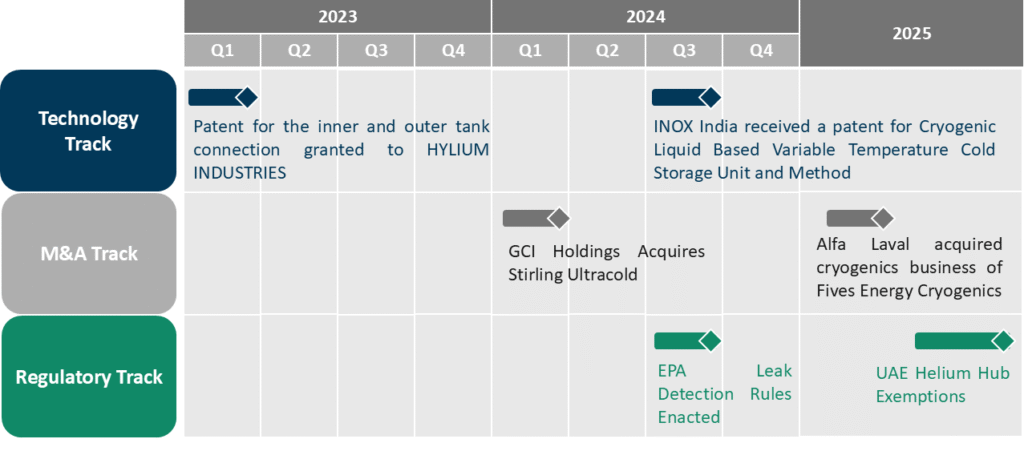

Cryogenic Competitive Moves Timeline: 2023-2025

Three Non-Negotiable Investments for 2025

-

-

- Digital Twins for Cryogenic Assets

- Early adopters are seeing 31% reduction in boil-off losses (ExxonMobil case study)

- Implementation cost: $4 to 7 million per major facility

- Alternative Coolant R&D

- Helium prices have increased nearly 200% since 2020

- Nitrogen-based systems show major cost reduction in semiconductor applications

- Regulatory War Rooms

- New EPA leak detection rules will add CO2e costs

- Firms with dedicated compliance teams are securing 15% faster permitting

- Digital Twins for Cryogenic Assets

-

The Make-or-Break Decision Matrix

For CEOs evaluating market entry or expansion:

|

Strategic Option |

Capability Requirement | Time to ROI |

| Greenfield LNG equipment manufacturing | ASME B31.3 certification |

5-7 years |

|

Pharma cold chain M&A |

GMP validation | 2-3 years |

| Aerospace component JVs | ITAR compliance |

3-4 years |

What separates market leaders here is their portfolio sequencing – we’re seeing winning players deploy a “tiered commitment” strategy: first securing anchor tenants through off-take agreements (de-risking capex), then layering in M&A for immediate capability access, while simultaneously funding R&D for the next regulatory cycle.

The catastrophic mistake? Attempting parallel plays without this staged approach – three firms have written off over $ 1 billion in stranded cryogenic assets since 2022 by misjudging these timelines. Your move isn’t just about choosing a path; it’s about choreographing how each decision unlocks the next strategic option.

Conclusion: Positioning for Cryogenic Dominance

The cryogenic equipment market is no longer a supporting industry – it has become a critical enabler of global energy security, healthcare resilience, and space commercialization. As the sector approaches its USD 26 billion inflection point, leadership teams must recognize that traditional market approaches will fail. The winners of this decade will be those who treat cryogenic infrastructure as a strategic control point rather than a procurement category.

Immediate Imperatives for Leadership Teams:

-

-

- Reconfigure supply chains to hedge against helium shortages and alloy tariffs, with dual sourcing becoming non-negotiable

- Embed regulatory foresight into R&D pipelines, as upcoming hydrogen purity standards (2026) and space-grade certifications will strand non-compliant assets

- Deploy countercyclical capital – our models show a 12-18 month window to acquire distressed specialty fabricators before the next capacity crunch

-

The cold reality? This market will bifurcate into architecture takers (those dependent on others’ standards) and architecture makers (firms like Linde and Air Products defining the next-gen infrastructure).

-

-

- Energy Transition: Every $1B LNG project now requires $220M in cryogenic CAPEX (up from $180M in 2020)

- Biopharma: Cell therapy approvals will double by 2027, demanding 40% more cryo-storage

- Aerospace: New entrants are rewriting propulsion economics – your equipment specs must adapt or perish

-

Our team deploys battlefield reconnaissance-style market scans to identify your winning position – request the Cryogenic Power Grid Map