Strategic Context: Understanding the OHV Ecosystem

Off-highway vehicles – encompassing excavators, tractors, bulldozers, and all-terrain vehicles (ATVs) – are critical enablers of operational excellence in rugged, non-paved environments. Off-Highway Vehicles (OHVs) spanning across construction, agriculture, mining, and recreational utility vehicles form the backbone of infrastructure buildout, food production, and resource extraction. Today, this sector is no longer driven solely by capital cycles. Instead, three structural shifts i.e. emissions regulation, electrification, and autonomy are redefining equipment design, fleet economics, and competitive advantage.

The market’s growth is propelled by global megatrends, including urbanization (50% of the global population now urban, projected to reach 5 billion by 2030), infrastructure investments (e.g., China’s USD 679 billion Belt and Road Initiative), and the shift toward sustainable technologies.

However, clients must navigate challenges such as high capital costs, stringent regulations, and supply chain volatility to unlock the market’s full potential. Our analysis identifies four strategic imperatives for success: leveraging technological innovation, optimizing regional strategies, mitigating operational risks, and aligning with sustainability mandates.

Structural Shifts — Why This Cycle is Different

1. Regulation as a Catalyst, Not a Constraint

-

-

-

- EU Stage V, US Tier 4 Final, and China’s Stage IV NRMM standards have effectively reset baseline technology requirements. Beyond after-treatment, they mandate digital monitoring (e.g., PEMS, GPS tracking), pushing OEMs to integrate compliance-by-design.

- For fleets, compliance logs are now RFP requirements.

- Implication: vendors who package emissions reporting as part of uptime contracts will differentiate.

-

-

2. Electrification Moves Beyond Pilots

-

-

-

- Until 2023, electric OHVs were confined to compact classes. With Volvo CE’s EC230 Electric excavator and similar launches, the 20–25-ton class is entering commercial scale.

- The economic case is context-specific: urban construction (noise & air quality mandates) and closed-site mining lead adoption; open rural construction remains diesel-dominant.

- Implication: expect “machine + charger + uptime SLA” bundles to become the winning commercial model.

-

-

3. Autonomy as a Productivity Lever

-

-

-

- In mining, autonomous haul trucks have already moved >9.3 billion tonnes and driven >200 million miles without human drivers.

- Construction is next: partnerships (e.g., Caterpillar + lidar providers) signal a shift to modular autonomy kits that scale from operator-assist to full site automation.

- Implication: the narrative is moving from labor substitution to cycle-time consistency, safety, and incident reduction.

-

-

The Core Thesis: Disruption is Here – It’s Just Unevenly Distributed

The narrative that OHV is a “laggard” sector, immune to digital disruption, is a dangerous fallacy. Our engagement data reveals that the disruption is already present but is asymmetrical, creating both blind spots and opportunities for incumbents.

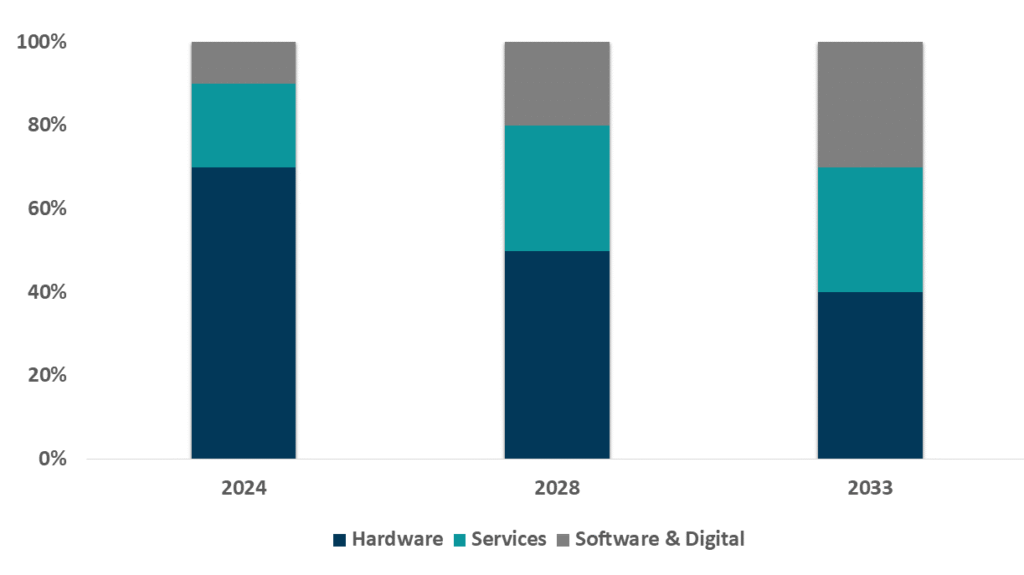

Hypothesis 1: Value is decoupling from the physical asset and migrating to the operational data layer.

The machine is becoming a platform. The real margin pool is shifting from selling a $500,000 excavator once every seven years to monetizing the $50,000/year in predictive maintenance, fuel savings, and productivity analytics it generates over its lifespan.

Hypothesis 2: The competitive set is expanding to include non-traditional players.

Your future competitor is not the other legacy OEM across town; it is a Silicon Valley software firm, a battery technology startup, or an energy company offering “haulage-as-a-service” and rendering asset ownership obsolete for your largest clients.

Value Pool Migration in the OHV Market

Strategic Recommendations for Stakeholder

OEMs & Tier-1s

-

-

- Bundle value, not just iron. Offer integrated solutions: machine + charger + uptime contract + compliance logs.

- Invest in autonomy modules. Scalable perception kits allow stepwise migration from assist to autonomy, spreading capex and building trust. Volvo CE’s autonomous excavator technologies, such as the Volvo Active Control system and pilot projects like the Electric Site, are designed to enhance safety by automating repetitive tasks, reducing operator fatigue, and improving precision.

- Simplify compliance. Architect platforms around common after-treatment and monitoring tech to serve multiple regulatory regimes.

- Partner with technology providers, as Caterpillar did with mining firms for electric trucks, to co-develop solutions.

- Offer leasing and rental programs to address high capital costs, particularly in emerging markets. John Deere’s leasing and financing programs have significantly contributed to its market presence in Africa by addressing affordability barriers for smallholder farmers. For example, the company’s collaboration with Hello Tractor and its focus on low-cost, high-impact financing models have driven adoption in key markets like South Africa, Nigeria, and Ethiopia.

-

The capability gap in software, AI, and energy cannot be built in-house quickly enough. You must acquire or form strategic joint ventures with non-traditional partners. This is not about sourcing components; it is about absorbing an entirely new DNA. We advise targeting partnerships with:

-

-

- Specialized AI firms for computer vision (autonomy).

- Battery technology companies for next-gen cell chemistry.

- Major cloud providers (AWS, Azure, Google Cloud) for data infrastructure.

-

Fleet Owners (Contractors, Farmers, Miners)

-

-

- Run telematics-based baselines. 8–12 weeks of duty-cycle logging enables evidence-based electrification pilots.

- Adopt autonomy for safety first. Position autonomy as a workforce stabilization tool; productivity gains follow naturally.

- Prepare compliance dossiers. Treat emissions/PN logs as part of tender prep — avoid last-minute documentation risk.

-

Investors

-

-

- Prioritize “software attach” Guidance, battery/thermal management, emissions reporting offer recurring revenue layers.

- Watch Asian mid-market OEMs. Local players with dealer networks and upgradable electric lines may capture share as global majors focus on high-capex segments.

-

Conclusion: From Heavy Iron to Intelligent Systems

The Off-Highway Vehicle industry is standing at an inflection point. What was once a hardware-driven, cyclical business is now being reshaped by regulation, electrification, and autonomy, with software and services emerging as the true profit pools. Winning players will not simply manufacture reliable machines — they will deliver integrated productivity solutions that combine uptime, compliance assurance, and digital intelligence.

For leadership teams across OEMs, suppliers, and fleet operators, the implication is clear: future competitiveness will be determined less by the size of the equipment and more by the strength of the ecosystem wrapped around it. Capital cycles will continue, but the value creation levers are shifting decisively toward software attach, service bundles, and regulatory proof points.

Strategic imperatives to act on now:

-

-

- Pivot from sales to solutions: package machines with charging, autonomy, uptime guarantees, and emissions reporting.

- Invest in modular autonomy and electrification: build pathways that let customers adopt stepwise without full fleet turnover.

- Embed compliance and ESG transparency: make emissions and carbon data part of every RFP response.

- Target recurring revenues: drive higher attach rates for software and services to stabilize margins through cycles.

-

Request a tailored executive briefing or sample analysis to see how these shifts in the OHV market translate into growth opportunities for your business.